Rivalry has belatedly launched its monetary outcomes for Q1, and whereas the esports-first bookie says it’s pleased with its progress, a few of the firm’s strikes have confirmed controversial.

After months of hypothesis, the Toronto-based betting platform has lastly revealed its efficiency throughout the first monetary quarter of the 12 months. Its biggest achievement is a predicted 58% discount in working prices in comparison with 2024. An elevated internet income of $1.3 million has additionally helped carry it nearer to profitability. Nonetheless, these enhancements have come on the expense of creating esports a decrease precedence. That leaves some fearful that it may very well be alienating its authentic core viewers.

The present buying and selling worth for Rivalry Corp. (RVLY.V) stands at $0.07 USD per share, far under its authentic launch worth of $2.35. Share costs suffered an 80% decline final October and have by no means recovered out of penny inventory territory.

(Picture credit score: Rivalry Corp.)

Traders appear ambivalent concerning the firm’s numbers. Following the Q1 launch, Rivalry’s inventory briefly fell to simply $0.04 in pre-market buying and selling, however bounced again to its former worth in common buying and selling on July 17.

Whereas the corporate is inching nearer to profitability, it’s nonetheless burning capital. The issue is, because it pivots extra in direction of typical bookmaking, it overlaps extra closely with different, better-established corporations. Nonetheless, co-founder and CEO Steven Salz is optimistic about its long-term potential.

“This quarter marks the complete emergence of Rivalry 2.0 – leaner, sharper, and structurally stronger… We’ve rebuilt the muse of the enterprise round high-efficiency acquisition, high-value customers, and a proprietary product – and we’re already seeing the influence,” mentioned Salz in the investor relations assertion.

Is Rivalry nonetheless an esports betting website?

Whereas Rivalry nonetheless touts esports as its main focus, the corporate’s transfer towards conventional sports activities betting and on line casino choices could also be pushing away its esports-centric base.

Rivalry initially launched in 2018 as a devoted esports betting website. It didn’t supply any conventional sports activities betting choices, not to mention on line casino video games. That was seen as a daring transfer in an area stuffed with conventional sports activities betting websites doing little to distinguish themselves and treating esports betting as an afterthought, in the event that they supplied it in any respect.

(Picture credit score: Rivalry Corp.)

Rivalry’s standing as an esports-only betting website definitely differentiated it, but in addition put a ceiling on its potential person base. A number of partnerships with occasions and influencers helped bolster its status, and the positioning rapidly turned a widely known title in aggressive gaming.

Early customers will recall that the unique URL led to .gg slightly than .com, a reference to gamer slang that means “good recreation.” It modified its area extension to .com in 2019, in search of to determine its legitimacy in an area rife with unregulated opponents, lots of which additionally use .gg or .wager extensions.

Its technique continued to vary in 2022 with the addition of conventional sports activities, coinciding with adjustments in Ontario’s playing legal guidelines to permit for on-line sports activities betting. On one hand, the addition allowed esports bettors to put bets on conventional sports activities with no need to register with a separate operator. On the identical time, it diluted the model’s identification as an esports-first oddsmaker. Later the identical 12 months, the corporate started including on line casino choices, beginning with a easy crash recreation earlier than transferring on to slots, wheels, and different commonplace fare.

There’s little question that these different verticals have traditionally been extra worthwhile than esports betting. Nonetheless, making the product extra generic might have a detrimental influence on new participant acquisition, particularly given the saturation of the standard sports activities betting market.

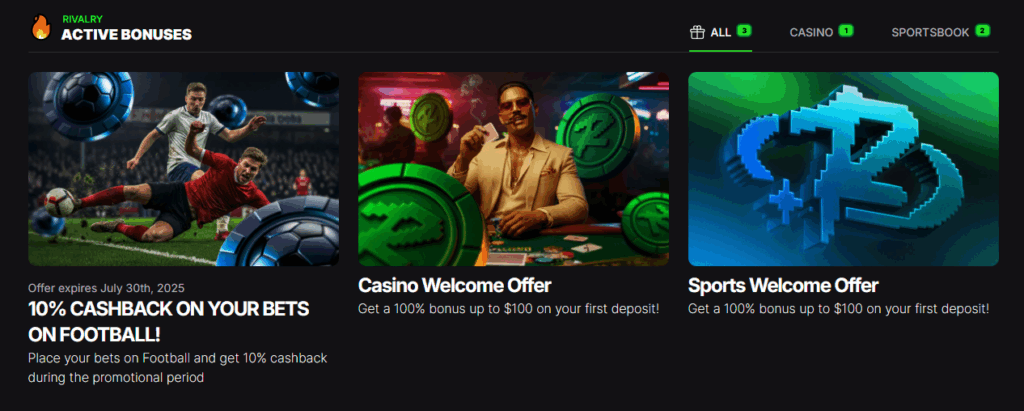

Rivalry’s identification seems to be converging with that of different playing websites. With out the esports-first hook it as soon as had, gamers may even see no purpose to select Rivalry over a bigger competitor. Meaning spending on bonuses, which may eat into the income Rivalry is hoping to see from these extra conventional verticals.

It’s price noting that on the time of writing, none of Rivalry’s present bonuses apply to esports.

(Picture credit score: Rivalry Corp.)

There’s maybe no clearer indication of Rivalry’s struggles than the a number of rounds of layoffs that started final 12 months in 2024. That included 29 misplaced jobs in July and 28 extra in October. Whereas shakeups are anticipated within the playing startup world, esports followers usually tend to be tuned in to the finer factors of the business in comparison with conventional sports activities followers.

The downsizing and lack of deal with esports might have slowed down buyer acquisition for the web site in 2025. Notably, Rivalry didn’t point out person acquisition anyplace in its Q1 launch. Nonetheless, income are paramount for publicly traded companies. If the bookie is lastly in a position to cross over into the black, that may probably free its arms to try a comeback.